What's New

Version 11 Latest

Added Feature:

1. Now Asset Names in the Portfolio sheet work as clickable links to their Screener Webpage.

2. Added dynamic links in the Portfolio, to quickly jump straight to TradingView for detailed charts and analysis..

3. XIRR calculations are now more advanced. User can now switch XIRR calculation methods between "All-Time" or "Active" holdings.

Tweak:

1. Now Portfolio Performance measured using unitized NAV, which removes cashflow distortion and reflects true performance.

Removed:

1. Days count from the Portfolio sheet.

2. Unncessary Conditional Formating.

Version 10.3

Tweak:

1. Script Improvements.

Version 10.2

Added Feature:

1. Ability to view allocation in the Portfolio Sheet by Asset Type or for the Entire Portfolio.

2. Added Drop down to switch allocation calculation between Investment Value and Current Value.

3. Now Dashboard can show Monthly Investment needed for reaching the Target.

Version 10.1.2

Tweak:

1.Optimized few formulas

Fix:

1.Errors in formulas

Version 10.1.1

Fix:

1.Errors in formulas

Version 10.1

Fix:

1. Number rounding issue.

2. Error in Benchmark Calculation.

Version 10

Added Feature:

1. Custom Daily Alerts

2. Added Holding Duration in Portfolio Sheet.

3. Added more useful insights in Portfolio Sheet.

4. Added option to disable recording Daily Value of an Asset.

Tweak:

1. Made some changes in the sheet structure.

Version 9

Added Feature:

1. Now Tax Sheet can able to show Quarters wise gains for the selected Financial Year.

2. Now Overview Sheet can show Unrealized Long Term & Short Term gains or losses.

3. For Tax calculations purpose now Charges has divided in to two categories Charges(A) – which are deductible from gains, Charges(B) – which are not deductible from gains.

4. Now users can delete Transactions using Add Transactions Form.

Tweak:

1. Optimized Scripts for faster calculations.

Fix:

1. Errors in some Scripts.

Version 8.1

Added Feature:

1. Added Portfolio Returns Chart in Dashboard.

2. Now Dashboard can show Portfolio CAGR and Future estimated value.

Fix:

1. Errors in some Scripts.

2. Optimized some Formulas.

Version 8

Added Feature:

1. Ability to change Asset Names in Data Sheets.

2. Added ERASE button to erase all the data in the Portfolio Tracker

Tweak:

2. Instead of fetching the XIRR separately for each asset from the Overview sheet, the script now itself calculates XIRR directly, delivering more faster results.

3. Optimized Formulas.

Version 7

Added Feature

1. Can record daily Invested Value, Market Value for every asset in the Portfolio. All this data will be recorded in a new workbook called “Asset History”.

2. Now, Portfolio Performance Graph can show Invested Value along with Market Value.

3. Ability to Import new data without overwriting existing data.

Fix:

1. Fixed errors for SPIN-OFF transactions in FIFO and Tax Script.

Version 6.1

Tweak:

1. In Tax sheet, if Apply Indexation is turned off, instead of value 0 now its shows Cost of Acquisition.

Version 6

Added Feature:

1. Added What If feature in the Dashboard sheet, which helps in testing and analyzing how the portfolio would react under different market conditions.

2. Reintroduced Short Term and Long Term units in the Overview sheet (previously formula-based, now script-driven).

3. Added the “Enable Scripts” button in the Disclaimer sheet to enable scripts and add all required triggers with a single click, eliminating the need for manual trigger setup.

Version 5.2

Added Feature:

1. Added drop downs in Tax sheet to calculate estimated Taxes for individual Stock, Mutual Funds and ETFs.

Removed:

1. Due to errors removed, Short Term and Long Term units of an Asset in Overview sheet.

Version 5.1

Added Feature:

1. To view Short Term and Long Term units of an Asset in Overview sheet.

Fix:

1. Errors in Tax script

Version 5

Added Feature:

1. Introduced a new Tax sheet for instant STCG and LTCG calculations with a single click.

2. Added the ability to customize tax rates and exemption limits for Stocks, Mutual Funds (Equity, Debt, and ELSS) and ETFs.

3. Can estimate total tax with or without Indexation.

Version 4

Added Feature:

1. Now can filter data based on Sector/Category in Portfolio Sheet.

2. Added a Refresh button in the Overview Sheet that optimizes data in the Transactions Sheet by sorting data chronologically, clearing empty rows between data and recalculate FIFO values.

3. Now Portfolio Sheet can show Trend based on Simple Moving Average.

Tweak:

1. Optimized Formulas.

Fix:

1. Minor Bug Fixes

2. Fixed Errors and updated FIFO Script for more accuracy.

Version 3.2

Added Feature:

1. To view daily, weekly, 1 month, 6 month, 1 year and 5 year portfolio return compared to selected Benchmark

2. To view Live Price, Average Buy Price, Lowest Buy Price and Highest Buy price of an Asset and Asset Types in Overview sheet.

Tweak:

1. Added drop down to view Top 5 and Bottom 5 Stocks, Mutual Funds and ETFs in Dashboard Sheet.

2. Updated Portfolio Performance Chart

3. Added Dividends Income Chart

Fix:

1. Fixed, charges not Including while calculating FIFO

Version 3.1.1

Tweak:

1. Updated Scripts

Version 3.1

Added feature:

1. Now filter transactions in Overview sheet using Dates.

Tweak:

1. Sell and Withdraw transactions are now handled using the FIFO method.

Version 3

Added feature:

1. Import Data from previous version sheets to this Updated Sheet.

2. Abitility to track ETFs and Mutual Funds.

3. Now Dashboard can show Investments in Stocks, ETFs and Mutual Funds seperatly.

4. Know Standard Deviation at Portfolio Performance Graph.

Tweak:

1. Optimized XIRR and Benchmark Calculations and moved them to Transactions Sheet.

Version 2.1

Added feature:

1. For adding Demerge (Spin-Off) Transactions.

Version 2

Initial Release

Google Sheets

Portfolio Tracker

Best free google sheet stock market portfolio tracker in 2025 . Free Stock Market Investments Tracker made with Google Sheets to track Stocks, Mutual Funds, ETFs. XIRR Performance, Benchmark Comparison, capital gains calculator, long term capital gains, short term capital gains with indexation benefit.

Unify All Your Stock Market Investment Transactions in One Place with this Ultimate Google Sheet Portfolio Tracker for Free.

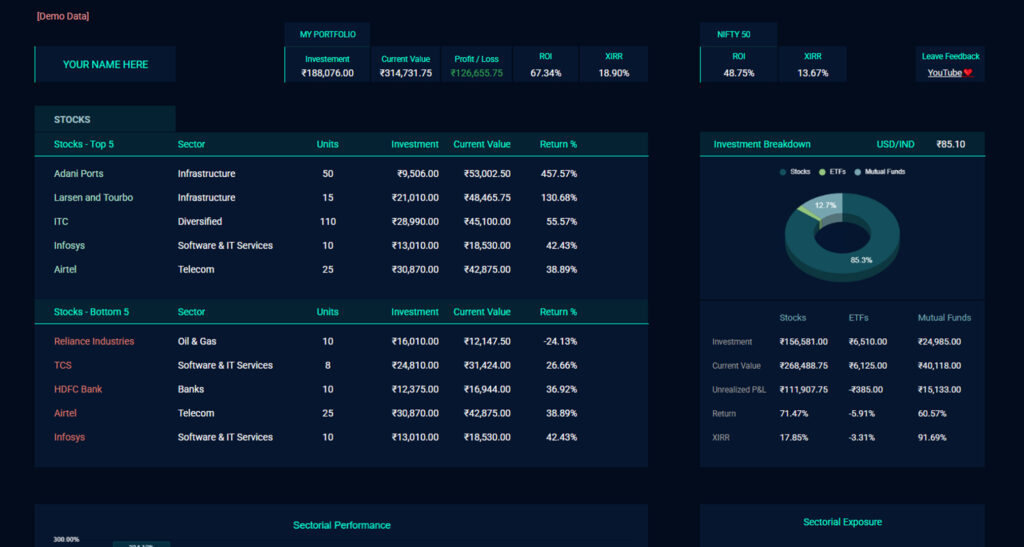

Dynamic Dashboard

Easily visualize your entire investment portfolio using a powerful dynamic dashboard. Track stocks, mutual funds, and ETFs with clear visuals.

Benchmark Comparision

Compare your portfolio's performance against top stock market benchmarks. This free investment tracker gives you insights on where you stand.

Transaction Forms

Add or edit transactions with ease using dedicated forms. Whether it's a stock buy, mutual fund SIP, or ETF sell, every action is recorded accurately.

XIRR

Get XIRR for your stocks, mutual funds, and ETFs. No formulas to write, just plug in your transactions and let this investment tracker do the rest for you.

Coporate Actions

Track major corporate actions like stock splits, bonuses, dividends, and demergers. This free portfolio tracker adjusts your holdings and cost basis using FIFO logic.

Track Mutual Funds & ETFs

Track every SIP and Withdraws with ease. Supports detailed mutual fund and ETF investment tracking. Capital Gains Calculation.

How to Setup?

Free Users:

- Go to File -> Make a Copy

- Enable Scripts

- Create Daily Time Driven Triggers for recordHistoricalData() and updateXIRRInPortfolio() functions

- Click here for Video Guide

Premium Users:

- Go to File -> Make a Copy

- Click on Enable Scripts button in Disclaimer Sheet.

Why should I use this Tracker?

This portfolio tracker is designed for individuals who want to maintain a clean, organized record of their investments across multiple brokers, mutual fund platforms, and financial institutions, all in one place.

It helps you consolidate your entire portfolio, stay aware of your investment activities, and track your financial growth with complete clarity. By regularly updating your transactions, you naturally build better financial discipline, make more thoughtful investment decisions, and create a personalized record that truly reflects your unique investing journey.

Whether you invest in stocks, mutual funds, or ETFs, this tracker offers you a simple and flexible way to understand and manage your investments smartly and confidently.

What is XIRR?

XIRR (Extended Internal Rate of Return) is a powerful financial metric that calculates the annualized return of investments where multiple cash flows occur at different times, such as buying and selling stocks or mutual funds on different dates.

Unlike simple return percentages, XIRR considers both the amount and the timing of every cash flow, making it the most accurate way to measure your portfolio’s performance over time.

This makes XIRR a fair way to judge your investment performance, especially when you have made multiple transactions over time.

This Google Sheets portfolio tracker automatically calculates your XIRR based on your entered transactions, helping you truly understand your real return rate, not just notional gains or losses.

When you are new to investing, your XIRR may appear unusually high or low, and that’s completely normal. Since XIRR projects annual returns based on limited early data, short-term variations can cause big swings. As you continue investing over time and build a longer track record, your XIRR will gradually stabilize and reflect your true annualized investment performance more accurately

Why are there two types of charges?

In the tracker, “Charges (A)” refers to the sum of expenses that are deductible from your investment gains (such as brokerage, transaction fees, etc.), while “Charges (B)” covers non-deductible charges like Securities Transaction Tax (STT).

Although “Charges (B)” does not impact the realized gains shown in the Portfolio sheet, it is important for accurate LTCG (Long-Term Capital Gains) and STCG (Short-Term Capital Gains) calculations in the Tax sheet. This distinction ensures precise investment tracking.

Total Realized P/L differs from Portfolio & Tax Sheet.

The difference arises because the Portfolio sheet shows your realized profit or loss after considering all applicable charges, providing a more realistic picture of your net investment returns.

On the other hand, the Tax sheet follows the Indian tax rules where certain charges like STT cannot be deducted while computing capital gains.

Thus, the realized figures in the Tax sheet and Portfolio sheet will naturally differ, reflecting tax-compliant gains versus actual investment gains.

Thank You!

These amazing people’s support is the reason this Portfolio Tracker is alive, growing, and getting better.